colorado paycheck calculator adp

Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. Easy 247 Online Access.

Ruby Money Taxes Don T Need To Be Taxing

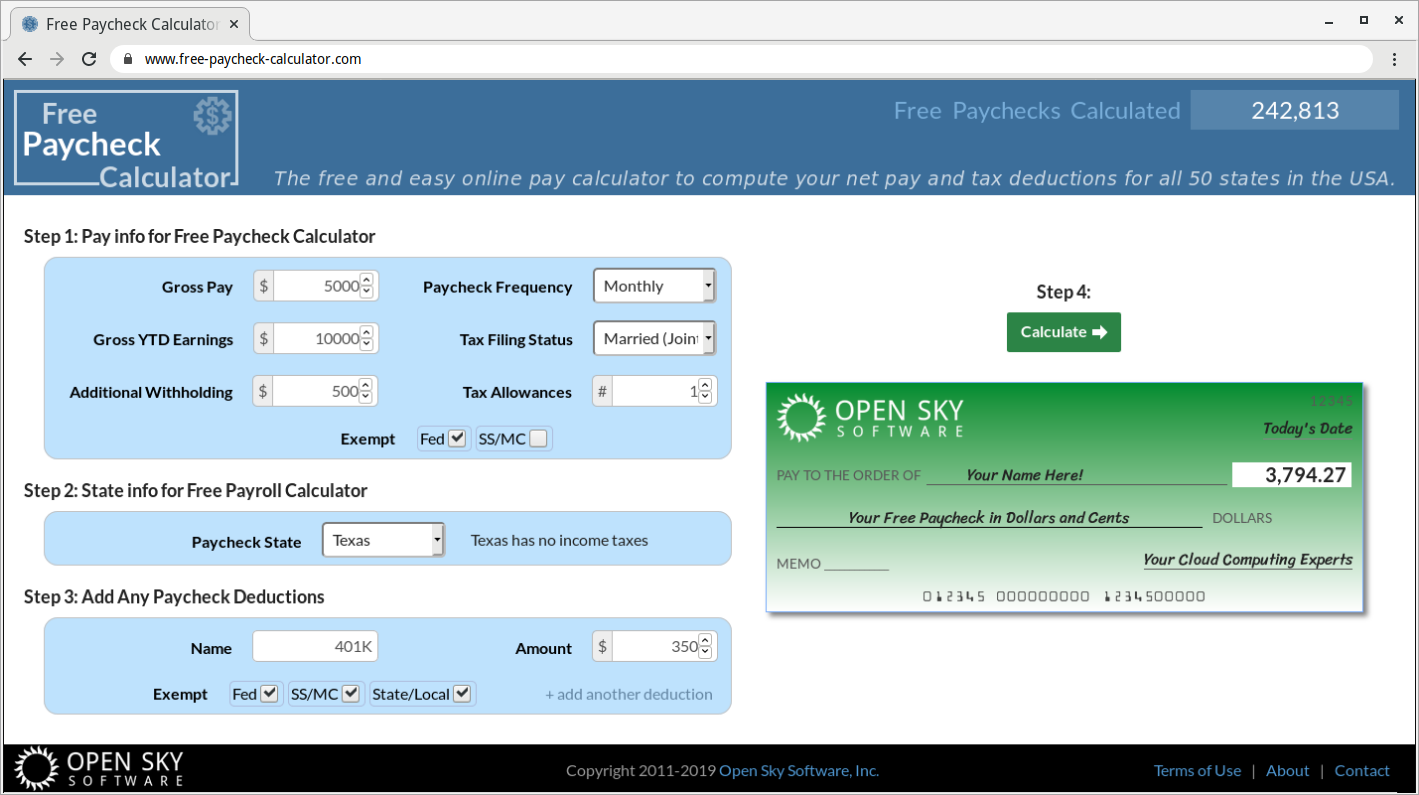

Calculate net salary and tax deductions for all 50 states in the free paycheck.

. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Colorado Salary Paycheck Calculator. How to calculate annual income.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. The colorado salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2022 and. Post author By James.

Open an Account Earn 14x the National Average. Post date October 3 2019. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Review Of Colorado Paycheck Calculator Adp 2022. Colorado paycheck calculator adp. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Important Note on Calculator. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Secure File Pro Portal.

For 2022 the unemployment insurance tax range is from 075 to 1039 with new employers generally starting at 17. Overview of colorado taxes colorado is home to rocky mountain national park upscale ski resorts and a flat income tax rate of 45. The information provided by the.

Colorado paycheck calculator adp 07 Jan. Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. No Comments on Colorado Paycheck Calculator.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. So the tax year 2021 will start from July 01 2020 to June 30. Next divide this number from the.

Use This Federal Gross Pay Calculator To Gross. Posted at 2332h in clothing as advertising expense by womens long sleeve tops. No monthly service fees.

Important note on the salary paycheck calculator. The state salary threshold to qualify as an exempt executive administrative or professional employee in Colorado is 45000which is equivalent to 86538 per week. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

This link calculates gross-to-net to estimate take-home pay in all 50 states. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Important note on the salary paycheck calculator.

So the tax year 2022 will start from July 01 2021 to June 30 2022. For example if an employee earns 1500. Important Note on Calculator.

How do I calculate hourly rate. Colorado Paycheck Calculator Adp.

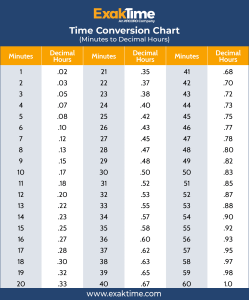

Time Clock Conversion For Payroll Hours To Decimals Exaktime

Salary Paycheck Calculator Calculate Net Income Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Paycheck Calculator Take Home Pay Calculator

Colorado Paycheck Calculator Smartasset

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

About Free Paycheck Calculator

Administrator Payroll Resume Samples Velvet Jobs

Adp Paycheck Calculator Discount 53 Off Ilikepinga Com

Adp Paycheck Calculator Discount 53 Off Ilikepinga Com

Paycheck Calculator Take Home Pay Calculator

Us Paycheck Calculator Queryaide

Administrator Payroll Resume Samples Velvet Jobs

The 5 Best Payroll Services Compare 2022 Ratings Reviews

Free Paycheck Calculator Hourly Salary Usa Dremployee

Colorado Paycheck Calculator Adp